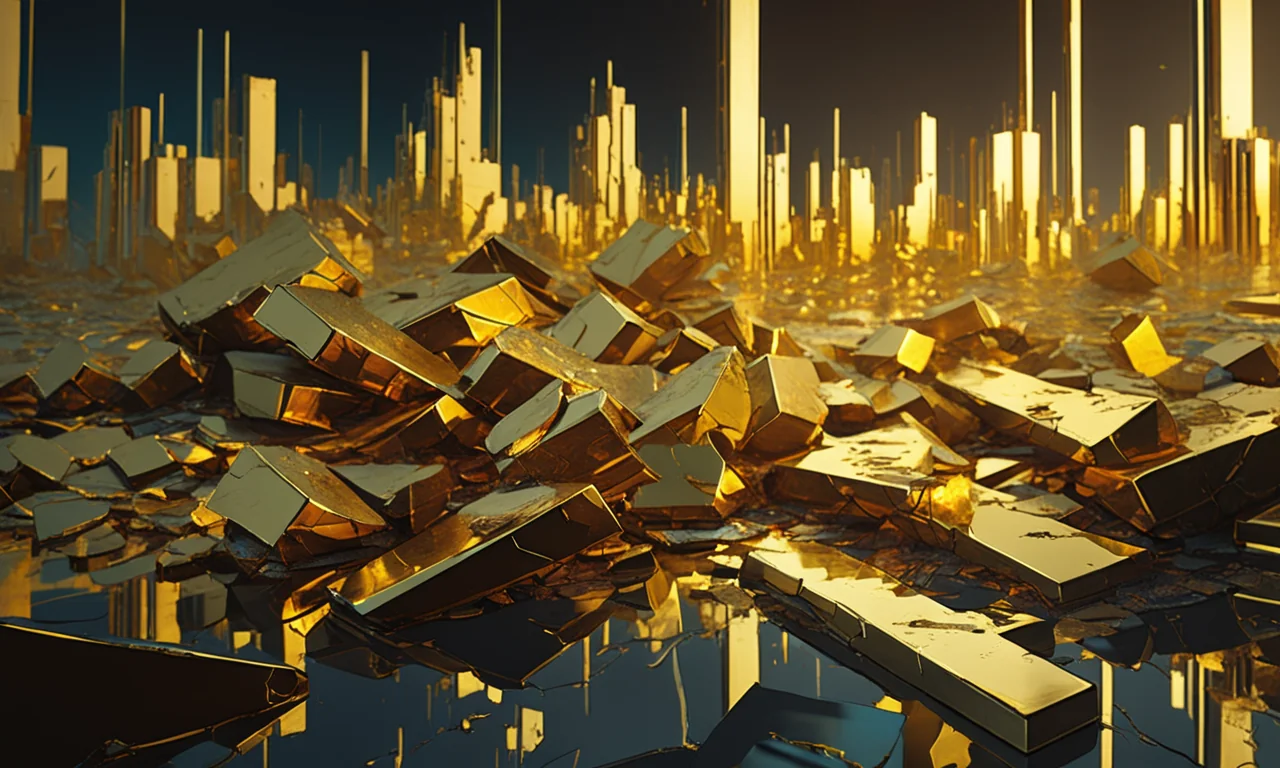

Gold's surge eclipses the crypto market as $773M liquidations hit

The selloff underscores shifting risk preferences as investors pivot to safety and discipline.

Across r/CryptoCurrency today, the community grappled with a fast, violent deleveraging while re-examining the narrative tug-of-war between digital assets and traditional safe havens. Discussions coalesced around how leverage and liquidity shape price moves, why gold's surge is reframing risk, and whether politics and prediction fatigue are dampening conviction.

Leverage, liquidity, and the mechanics behind the whipsaw

Traders centered the day's volatility around cascading liquidations, with many pointing to the market-wide shakeout captured in a detailed bloodbath update and a separate data burst on $773 million wiped in 60 minutes. In parallel, the selloff's cause was dissected in a community post offering a plain-language explanation of the crash, shifting attention away from exchange conspiracies and toward the simple reality of overextended positions meeting thin liquidity.

"Binance doesn't dump anything ever; customers of Binance dumped. Coinbase doesn't dump anything ever; customers of Coinbase dumped. It is the same asset trading on every exchange."- u/StatisticalMan (483 points)

The microstructure lens widened to OTC flows and institutional balance sheets, as one analysis argued that Strategy has provided $6.8B of exit liquidity for sellers, potentially smoothing drawdowns while enabling heavyweight buyers to accumulate off-exchange. Against that backdrop, sentiment on the subreddit's front page increasingly converged on risk controls rather than forecasts, reflecting a community recalibrating toward durability over drama.

"Pro tip: don't use leverage..."- u/RT82X (177 points)

Flight to safety vs. asymmetry: the narrative tug-of-war

A striking macro data point reframed relative value, with the community spotlighting how gold nearly added Bitcoin's market cap in a single day and renewed “risk-off” instincts contrasted with crypto's recent fragility. The shifting ethos surfaced culturally as well, through a pointed meme asking how the first-gold-then-Bitcoin believers are doing, illustrating a mood swing from bravado to reflection.

"If you track polymarket expectations around currency debasement and fiscal risk, this looks like old money moving before new money wakes up. Gold moves when institutions get nervous, Bitcoin usually follows after sentiment flips..."- u/Glittering-Health889 (73 points)

Even as safe-haven flows gained airtime, advocates argued that crypto remains compelling via an asymmetrical bet framing, with market-cap context reminding investors how small the asset class still is relative to gold and global equities. The tension between “defense-first” capital and “optionality-seeking” capital is defining the current narrative, and both camps are stubbornly present.

Confidence, politics, and prediction fatigue

At the individual level, conviction is mixed: some asked candidly whether crypto is starting to fade amid the AI capital shift, while steady accumulators of BTC and ETH described a quieter, longer-horizon discipline. The community's tone favors resilience over euphoria, an adaptive stance for a maturing market.

"The dumb money comes and goes; only a year ago people were going memecoin crazy on here."- u/jimmybirch (243 points)

Politics layered additional uncertainty, with industry figures reportedly distancing from the White House and reassessing what “pro-crypto” leadership should look like. In the absence of clarity, the subreddit leaned into scenario-thinking through a gallery of 2026 Bitcoin predictions that underscored a simple truth: the path is contested, and positioning beats prophecy.

Data reveals patterns across all communities. - Dr. Elena Rodriguez